Overview

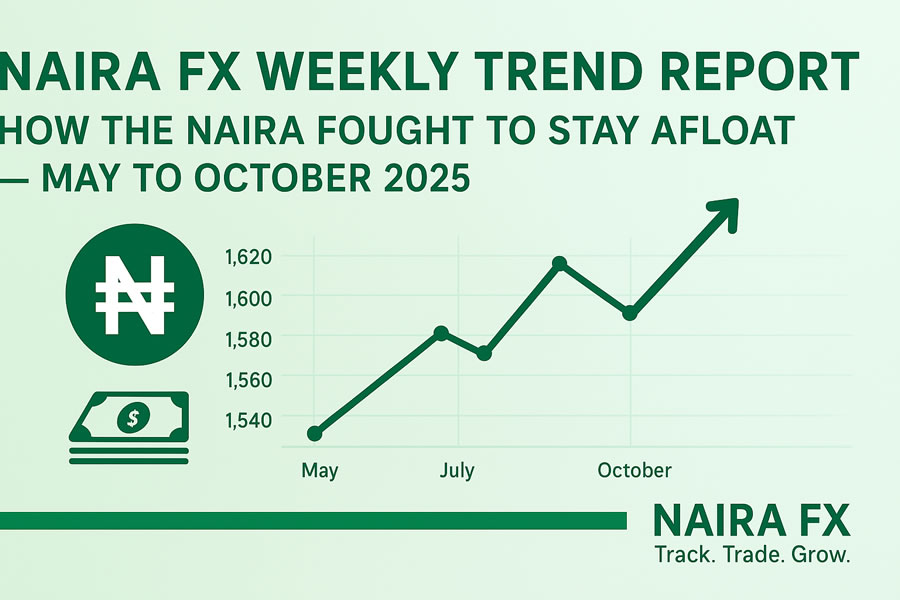

Between May and October 2025, Nigeria’s Naira experienced a dramatic series of fluctuations against the US Dollar — moving from ₦1,615 in late May to about ₦1,498 by October 10, 2025.

Although the Naira recorded brief rebounds, the general trend points to a slow but steady depreciation, reflecting pressure on Nigeria’s foreign-exchange reserves and liquidity constraints within the parallel market.

At Naira FX, we track these daily market shifts to help traders, remittance users, and investors buy and sell USD or USDT at the most competitive rates — ensuring you always get value for your Naira.

Monthly Breakdown

Monthly Breakdown

May – June 2025: Stabilization Phase

The Naira started strong, opening at ₦1,615 and showing slight resilience, closing June near ₦1,560.

Despite government interventions and increased dollar supply from remittances, market corrections continued to keep rates oscillating.

July – August 2025: Controlled Volatility

Throughout July, the Naira saw alternating days of appreciation and mild depreciation — hovering around the ₦1,540 – ₦1,565 mark.

However, early August introduced a gradual weakness, signaling reduced forex inflows.

September 2025: Market Retraction

September revealed a downward shift. From ₦1,529, rates slipped to around ₦1,482 at month’s end — a ₦47 drop.

This period highlighted speculative trades and tighter dollar access for importers, pressuring the Naira’s stability.

October 2025 (so far): Naira’s Quick Recovery Attempt

As of October 10, 2025, the Naira rebounded slightly from ₦1,450 to ₦1,498 after mid-week corrections and liquidity injections.

Market confidence remains cautious, although many expect moderate appreciation if the CBN’s interventions continue.

💡 What This Means for Traders

Buyers: Watch for dips near ₦1,480 – ₦1,500; these offer better buying windows before upward corrections.

Sellers: Peak opportunities often appear during high-demand days (e.g., salary weeks and import settlements).

USDT Traders: Pair your crypto conversions via Naira FX to secure instant settlement at real-time parallel rates.

🌍 The Bigger Picture

Nigeria’s Naira performance mirrors broader global and domestic factors — from dollar demand spikes to fiscal policy adjustments.

Experts predict continued micro-volatility as the economy adapts to post-subsidy reforms, while remittances and stable oil receipts could offer short-term relief.

At Naira FX, we simplify this complex landscape — letting you exchange, send, and receive funds via Zelle, Cash App, or bank deposits safely and instantly.

📈 Final Takeaway

Despite its struggles, the Naira shows resilience. Between May and October 2025, it lost about ₦117 per dollar — a moderate slide considering regional inflation and fiscal stress.

Continuous monitoring, transparent rates, and flexible transaction options make Naira FX your go-to platform for staying ahead of market movements.